asset-liability ratio of steel pipe industry will reduce to less than 60%

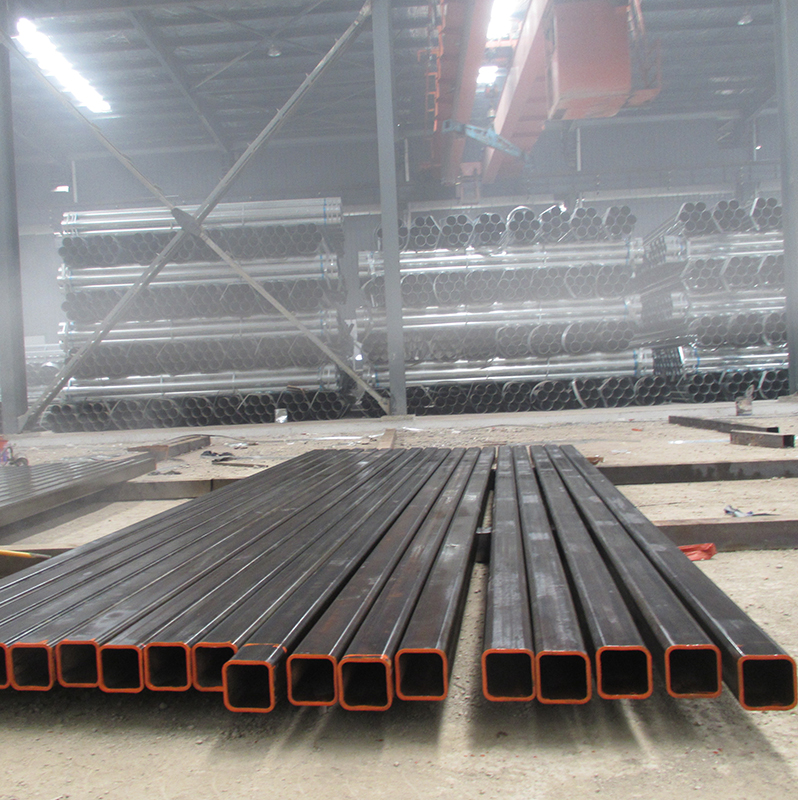

In the past three years, the steel industry has eliminated 150 million tons of excess capacity and completely eliminated steel pipe with low quality. However, the supply-side structural reform for structural steel pipe is far from completing and the asset-liability ratio of the steel industry is still too high. How to relieve the burden of steel pipe enterprises? This is an important task for the entire steel industry in the coming years. Steel pipe industry has achieved a stable and sound development trend in the past years, but there are changes and worries in the process. On the basis of continuous decline in the previous two years, the asset-liability ratio dropped by 3.39 percentage points year-on-year to 65.74% at the end of November 2018. More than half of the steel pipe enterprises dropped below 60%, but there are still some enterprises above 60%. In 2019, we will be more active in defusing capital risks. It is an important task for steel pipe suppliers to reduce its asset-liability ratio to below 60 percent in three to five years. They will take full advantage of the favorable opportunities for efficiency improvement and take multiple measures to reduction.

The target from 70% to 60% was put forward at a forum. At that time, the goal of the agreement was: after 3-5 years of efforts, the average asset-liability ratio of the steel industry should be reduced from about 70% to below 60%, and the asset-liability ratio of most enterprises should be in the high-quality range of below 60%. Hollow section manufacturers generally agree that the industry has problems such as high asset-liability ratio and heavy debt burden, which restrict the long-term development and transformation. Deleveraging is a fundamental optimization of the capital structure and capital structure of enterprises, which is of great strategic importance to enterprises. According to the data, the average asset-liability ratio of the industry in 2016 was 69.6%, 13.8 percentage points higher than the average level of industrial enterprises. In the previous 16 years, average asset-liability ratio of the industry rose from 48.92% to about 70%.

With the substantial improvement of profitability, the reduction of leverage of steel enterprises can be carried out through debt repayment, asset disposal, and other ways. We should strengthen coordination with government departments and financial institutions, make good use of the capital and bond markets for rectangular hollow section. In addition, we should increase the proportion of direct financing, and reduce reliance on bank loans. Besides, capital operation and project financing can also be carried out.

Tel: +86 18202256900 Email: steel@tjdpbd.com